The $50 Billion Ponzi by Jamie Lee Hensley

What goes around comes around. If you are involved in multilevel marketing (MLM) or network marketing over the Internet, you might often hear detractors ridiculing your line of work as a scam or a sham. Certainly over the years there have been many direct marketing opportunities that have been less than legitimate. Many people turn up their noses at the idea of a home-based business and the concept of multilevel or network marketing.

These sentiments are reinforced by the aloofness of the Wall Street tycoons who feel that their brand of investing is the only legitimate form of wealth creation. In light of recent events, this would almost appear to be a humorous scenario except for the fact that millions of people have just lost billions of dollars. This all started with the meltdown of several Wall Street icons and the subsequent $700 billion bailout offer to them by the United States government. All of the economists that weighed in on the matter agree that this was a necessary step to prevent even worse financial conditions, but the small businessperson who is struggling with the economy and declining business revenues can seek no such bailout.

But something else has just come to light that is even more shocking and demonstrative of the true depth of the anarchy on Wall Street. Bernie Madoff, the one-time head of NASDAQ, was recently arrested and charged with massive fraud. It turns out that Mr. Madoff, who supposedly ran a huge and dynamically profitable hedge fund, had in fact constructed what is arguably the world's largest Ponzi scheme ever. In a Ponzi scheme, there is no real investment and no real value. Investors who get in early are paid by investors who come in later.

Such a scheme only works as long as people do not try to take their money out. Once withdrawals start to occur, the Ponzi pyramid collapses and the scam is exposed. In Mr. Madoff's case, he was able to avert this disaster for a number of years and quite illegally collected over $50 billion for his illicit scam. As the economy weakens, his investors became nervous and started withdrawing their funds. And that was the end of Mr. Madoff, as well as retirement savings for thousands of hard-working and honest people. He is now on house arrest--in his $7 million Manhattan apartment--awaiting trial. But the money is long gone.

The take away lesson here is that the only person who you can depend on for your future is you. You alone are responsible to understand your finances, and how they will impact your future, and to take steps to make sure that you will be able to live the life that you want to lead.

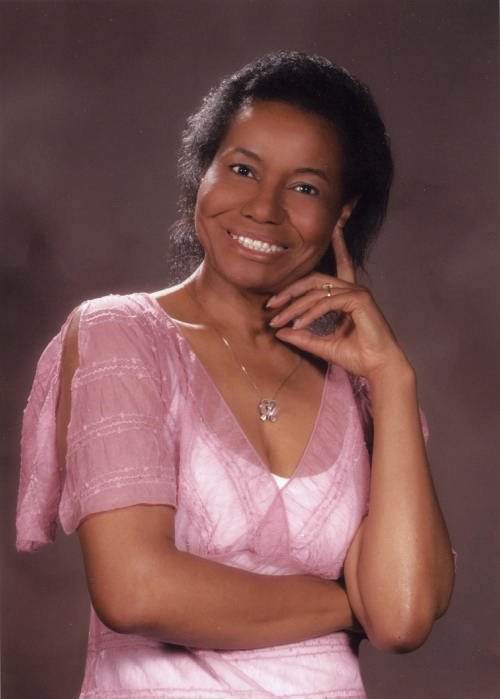

About the Author

My name is Jamie Hensley, and I have been a customer representative for over 10 years. I've dealt with restaurant's, both privately owned and franchised owned. Convenience stores, grocery chains, nonprofit organizations, real estate firms, insurance firms and banking firm's. I have experienced firsthand the impact that today's economy is having on these businesses.

http://www.JamieHensley.com

Article Source: http://www.GoArticles.com

Friday, January 02, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment